Naperville Data Center Campus Provides Taxes to Pay for Local Classrooms & Essential Services: Millions In New Local Recurring Tax Revenue

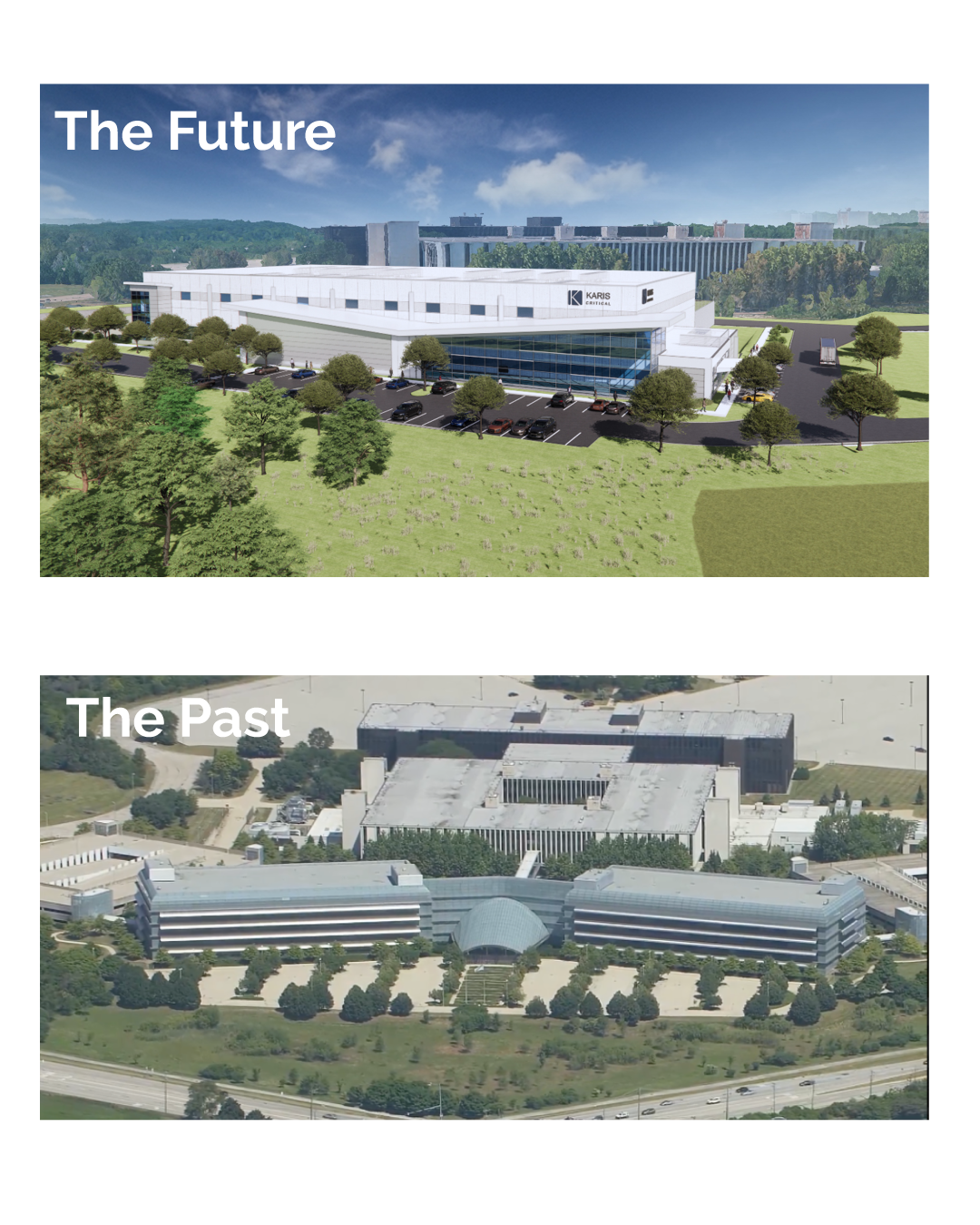

Data centers are the essential infrastructure that makes today’s digital, cloud-connected, on-demand society function, and they are an incredibly valuable addition to the local property tax base. Transforming a site that’s sat vacant for 25 years will unlock tremendous resources that can be reinvested in the community to make Naperville even better, by fueling economic growth and job creation, while generating millions in annual tax revenue.

The Naperville data center campus will pay for all required upgrades and necessary investments to deliver power to the facility. Naperville taxpayers and utility ratepayers will pay nothing for the upgrades, which will make the local utility even more resilient and reliable.

According to a Fiscal Impact Analysis conducted by Gruen Gruen + Associates, the data center campus is expected to create a windfall of nearly $2.25 million annually for local area governments, including up to $1.5 million annually for the City of Naperville.

Securing this investment in the community will generate millions in annual tax revenue to strengthen local schools, vital public services, and enhance the amenities that make the community thrive.

Download the full Fiscal Impact study here.

Key Findings: A Valuable Asset That Generates Substantial Revenue

- The initial buildout of Phase One will result in the City of Naperville receiving approximately $1.575 million in new annual recurring municipal revenue.

- The first building on the campus will generate $650,000 in total annual property tax payments, including approximately $500,000 to support local support classrooms and education for Naperville Community Unit School District 203.

- The data center will generate considerable utility taxes for Naperville, providing resources that can be reinvested to improve the reliability and resiliency of the City’s electric grid.

Regional Economic Impact of the Ongoing Operations of the Naperville Data Center (Impact Per Year)

| Local Government | Annual Revenue |

|---|---|

| City of Naperville – Property + Utility Taxes | $1,574,073 |

| Naperville School District 203 – Property Taxes | $499,175 |

| All Other Property Tax Payments Combined | $150,191 |

| Total Annual Expected Fiscal Resources for Local Governments | $2,223,439 |

Top Five Recipients of Annual Property Tax Payment of the First Building of the Karis Naperville Data Center Campus

| Taxing Entity | Tax Rate (2024) | Annual Property Tax Payment |

|---|---|---|

| Naperville Unit School District 203 | $4.7092 | $499,175 |

| City of Naperville | $0.4246 | $45,007 |

| Naperville Park District | $0.2835 | $30,051 |

| College of DuPage 502 | $0.1794 | $19,016 |

| City of Naperville Library | $0.1745 | $18,497 |

The estimates above are for the complete Phase One buildout of the campus, which will consist of one 211,000-square-foot building, with 30,000 square feet of Class-A office space to support the businesses that lease space on the campus. The total estimated annual property tax payment for 11 taxing bodies will be $649,366 for the first building.

If in the future a second building is constructed at the campus, a full build-out, the campus is projected to generate up to $4.5 million in new annual fiscal resources for local governments.